Tiger Brokers Australia is a low-cost broker that offers opportunities to enter into global stock markets like the US, Australia, Singapore, China, and Hong Kong. Basically, it allows you to trade stocks on the ASX, US, and Asian stocks.

Our, Tiger Brokers Review Australia will help with detail information about the platform fees, brokerage charges, trading fees, ETFs, pros and cons, Is Tiger Brokers safe or not, and many more.

So, I Hope you are excited to know more about Tiger Brokers Review and especially from an Australian point of view.

|

| Tiger Brokers Review |

The pricing structure seems to be complex to understand but will try to put it in simple words. Also, they offer many incentives or bonuses on joining and starting investing.

Recently, In our previous article about Superhero Trading Review, I noticed that many users are interested to know about more options. Well, many platforms are gaining popularity by providing low-cost brokerage for buying Australian shares and Asian Stocks from Singapore, China, and Hong Kong.

Because everyone wants to choose the best investment and trading app to participate in global markets.

Let's know in this review of Tiger Brokers.

About Tiger Brokers App

Tiger Brokers is an investing and trading platform providing instant access to the global market to buy and sell stocks, ETFs, futures, margins, and more with low-cost brokerage charges.

Starting in 2014 and subsidiary of online brokerage firm UPFintech Holding Limited. In March 2019, It is listed as NASDAQ global company (TIGR) with 9 million registered users worldwide.

Tiger Brokers has offices in China, Australia, the US, New Zealand, and Singapore.

Users can only use their mobile app or desktop app on windows and Mac because there is no website-based trading platform.

It provides you with one platform to manage all your assets and invest in different markets. For those who are looking for a broker that helps you to access Australian, US, China, Singapore, and other markets then you can try it.

Contact & Support

- Office in Australia - Tiger Brokers AU Pty Ltd, 2801/25 Bligh St, Sydney, NSW 2000

- Email: clientservice@tigerbrokers.com.au

- Phone: 02 9169 6999

- Call: Weekdays 09:00 am - 05:00 pm Sydney Time

- Telephone Service: Weekdays 9 am - 5 pm on Sydney Time

- Online Chat: Weekdays 9 am - 7 am (Next day) as per Sydney Time

And live chat option is also available in-app.

Tiger Brokers Australia Pros and cons

Pros or Advantage

- Great Sign-up Bonus or Incentives.

- First 3 months pay Zero brokerage fees on ASX and US stocks

- Allows to Trade stocks in Australia, the USA, and Hong Kong.

- Extra incentives on your first deposit

- Before going with real money you can trade with virtual funds for practice

- No minimum deposit requirement.

- Easy to use App with Technical Charts

- Competitive Trading fees

- Free In-Dept Market data

- Good Incentive on referring Friends.

- Active Online community of traders and investors sharing their thoughts and knowledge to help others.

Cons or Disadvantages

- May not be the lowest trading platform for ASX stocks

- Limited Learning Resources

- Crypto Access is not yet started

- The fee structure is quite difficult to understand for beginners

- No Web-based Platform for trading

Stock Markets Exchanges on Tiger Brokers

|

| Exchanges available in App |

In Australia, users can trade and invest in ASX, US, and Hong Kong exchanges.

- New York Stock Exchange (NYSE): ETFs, options, and shares

- Nasdaq Stock Market (NASDAQ): ETFs, options, and shares

- American Stock Exchange (AMEX): ETFs, options, and shares

- Hong Kong Exchange (HKEX): ETFs and shares

- US Pink Sheet (over-the-counter) exchange: Shares

- Australian Securities Exchange (ASX): ETFs and shares

Tiger Brokers Platform Fee | Tiger Brokers Settlement fee

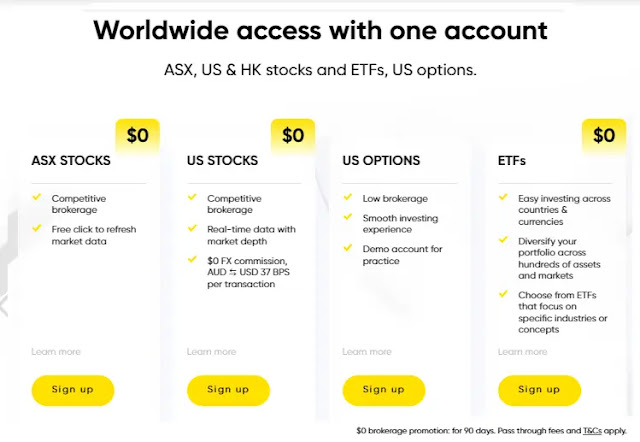

For a promotional purpose, every new user gets a Zero Brokerage offer for 90 Days on ASX and US stocks trading. After that regular charges are applied on every trade. Also, they provide some extra inncentives or bonus vouchers on your first deposit or trade.

|

| Stocks and ETFs Fees and brokerage charges |

So, below are the regular fees charged or Settlement fees by Tiger Brokers on purchasing stocks and ETFs.

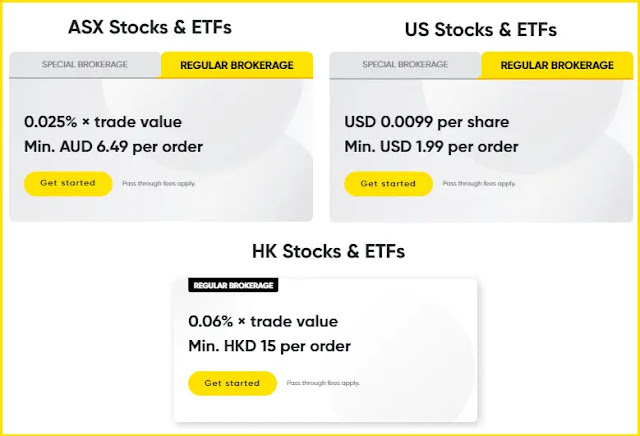

ASX Stocks & ETFs Fees

For ASX Stocks and ETFs, the regular brokerage is 0.025% × trade value and Min. AUD 6.49 per order.

| Type | Fees |

|---|---|

| Commission | 0.025% × Trade Value

Min. AUD 2.5 / Order |

| Platform Fee | AUD 3.99 / Order |

| Settlement Fee | 0.03% of trade value |

Hong Kong Stocks & ETFs Fees

Regular Brokerage for Hong Kong Stocks & ETFs is 0.06% × trade value and Min. HKD 15 per order.

| Type | Fees |

|---|---|

| Commission | 0.03% × Trade Value

Min. HKD 7 / Order |

| Platform Fee | 0.03% × Trade Value

Min. HKD 8 / Order |

U.S. Stocks & ETFs Fees

For US Stocks and ETFs, a regular Brokerage is USD 0.0099 per share, and Min. USD 1.99 per order.

| Type | Fees |

|---|---|

| Commission | USD 0.0049 / Share

Min. USD 0.99 / Order Max. 0.5% × Trade Value |

| Platform Fee | USD 0.005 / Share

Min. USD 1 / Order Max. 0.5% × Trade Value |

Above are Tiger broker's Fees and brokerage charges only and it is obvious that there will be charges by stock exchanges and regulatory bodies. Also, If you are trading international stocks currency exchange fees are also applied.

Note: There are many pass-through fees for each stock or exchange that are charged by the exchange. You can visit the official site for more updated and detailed information. - Visit

Is Tiger Brokers Safe?

Yes in Australia Tiger Brokers is legal and regulated by the Australian Securities and Investment Commission (ASIC).

Tiger Brokers (AU) Pty Limited, ABN 12 007 268 386, is licensed and regulated by the Australian Securities and Investment Commission (ASIC), Australian Financial Services Licence no. 300767 (AFSL).

US stocks are operated by US Tiger Securities, Inc. a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC).

Just for your information, Do you know you are not the legal owner of the shares you buy with these trading platforms?

Yes, Technically.

But, don't worry and decide whether it is really safe or not.

We will learn this part in detail in the below important points whether Tiger Brokers Is CHESS sponsored or not.

Alternatives to Tiger Brokers Platform

Tiger Brokers is an excellent trading platform that provides opportunities to scale your portfolio to different stock exchanges. It is not only one who offers it Right!, So you can compare with other platforms and alternatives of Tiger Brokers.

So For some reason If you are looking for its competitors then here are some good Best alternatives.

- Stake

- Commsec

- SelfWealth

- eToro

Would you like to add more? Let us know in the comment section or contact us.

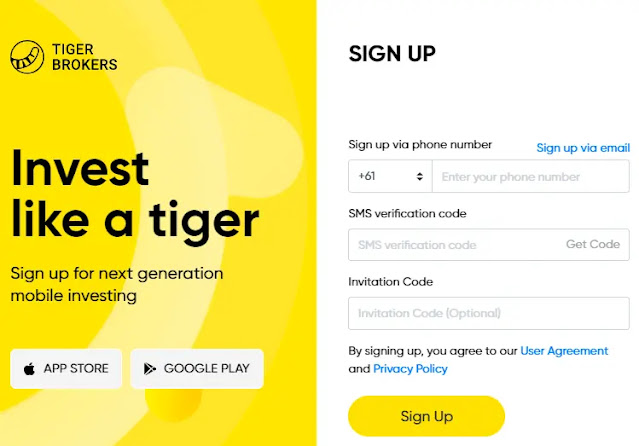

Sign-up Process in Tiger Brokers

|

| Tiger Brokers Signup and Create account |

Like any other platform signup process is similar, so to open an account in Tiger Brokers following below simple steps and get started.

- Visit the website and Open Sign up page - Open

- You can register using email or using phone numbers.

- Enter your Email or Mobile number, password, and Invite code ( Use the Invite code for extra benefits).

- Click on the Signup button and fill in all required details like nationality, country of birth, country of residence, and tax residency.

- Now, Verify yourself by uploading ID proof, such as your driver’s license or passport, and proof of your residential address.

- Your Account will go for verification and can be verified by waiting for 3 to 6 business hours.

However, In some cases, more time may take.

Is Tiger Brokers CHESS sponsored?

No, Tiger Brokers are not CHESS sponsored and you will not get a unique Holder Identification Number for your ASX stocks. Instead, users' shares are legally held in custody by Tiger Brokers for the client’s beneficial ownership. This means client's assets are still held in their individual names and are the beneficial owners of their shares.

Basically, If you buy stocks on the ASX through Tiger Brokers then your shares will be held in their name for you. You will be beneficial owners of that share held by Tiger Brokers Australia.

You can learn more from Chess sponsorship Shares.

From the Official website of Tiger Brokers Australia, Nov 2024

Similar to other fintech companies in Australia, all client assets are held in custody with Tiger Brokers Australia, and that’s why will be able to offer a competitive brokerage rate to our clients. Please note that We are authorized to provide custodial service to Australian retail clients as per our Australian Financial Service License: 300767.

It is similar to the Superhero Trading platform we discussed previously on our blog. You can search on our site.

Tiger Brokers Review

Well, our article was mainly focused on Tiger brokers Australia review, If you read other countries you can get an overview of the platform.

Overall, their app really beginners to explore the market and perform trade easily with competitive fees.

Again, If you are looking to invest in foreign stocks then you can give it a try. But If you want to use it only for Australian shares then you can find good alternatives to it.

Every platform has its own features and cons so it all depends on your requirement based on your investment.

So, Did you like our article? Please share it everywhere... Let us know your reviews in the comment section.

FAQ: Please also Ask

Is Tiger Brokers CHESS sponsored?

No, Tiger Brokers platform is not directly a CHESS Sponsorship platform as it works with Custodian to save shares database.

Can I trade using Tiger Brokers website?

No, there is no website-based trading available, so users can only use their mobile app or desktop app.

What are alternatives to tiger brokers in Australia?

There are many alternatives and competitors like Stake, Commsec, SelfWealth, and eToro.

Can I buy Cryptocurrency on Tiger Brokers?

No, Tiger Brokers Australia does not include Bitcoin or other cryptocurrencies. But they have the plan to launch crypto trading services soon in the future.

You may also like:

Best Direct Sales Clothing Companies

Disclaimer: The views expressed in this article are those of the writer alone and do not constitute financial advice. Advertisers cannot influence editorial content. However, do your own due diligence and seek professional advice before deciding to invest in one of the products mentioned. All information on this website is for general information only and should not be taken as constituting professional advice.